October 14, 2024, saw a massive plunge in international oil prices across the board, with contracts for American and Brent crude experiencing astonishing declines. Why has the market reacted so strongly? A series of complex economic factors and geopolitical issues are intertwined, becoming significant forces driving the fluctuation of oil prices.

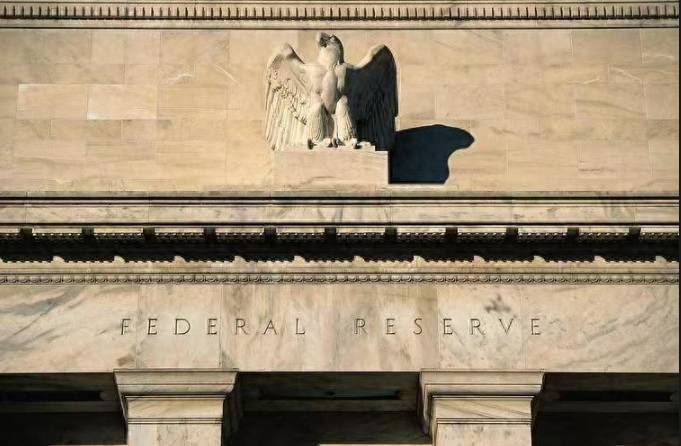

OPEC Downgrades World Oil Demand Growth Forecast

Starting with the latest data released by OPEC, the forecast for global oil demand in 2024 is 104.1 million barrels per day, which is a reduction of 106,000 barrels compared to last month's forecast. Similarly, the demand for 2025 has also declined, with an expected demand of 105.8 million barrels per day. This change undoubtedly has had a strong impact on market sentiment.

> "Oversupply" has gradually emerged as the main theme of the market. With global economic growth faltering, especially in major consuming countries, oil demand appears so weak and fragile. Once upon a time, optimistic growth expectations rose like the morning sun, but now they have dissipated, leaving behind only a mess.

Why has this situation arisen? The answer may be hidden in the fast-paced international situation of today. Globally, geopolitical tensions, economic slowdowns, and the rise of renewable energy—all of these are quietly changing the pattern of oil consumption.

Avoiding Strikes on Iran: Subtle Changes in the Situation

At the same time, Israel recently announced that it will avoid striking Iran's energy and nuclear facilities. This statement is like a breath of fresh air, perhaps offering some reassurance to the market. After all, for a long time, the nuclear issue surrounding Iran has always been shrouded in tension in the Middle East. Israel's statement may hint at a slight easing, but the market has not warmed up as a result.

Past conflicts and wars have always caused significant fluctuations in oil prices. Whether it was short-term or even instantaneous supply and demand imbalances, or long-term strategic games, they have made investors very nervous. But now, the market seems to be highly alert to this, reacting indifferently to Israel's statement.

> The argument of "oversupply" is not just a game of numbers; it is also a profound reflection on the state of the global economy. Faced with the continued weakness of demand, the market begins to re-examine its own confidence and future direction.Behind the Market's "Calm"

Behind this series of events, the market's "calm" reflects a deep-seated unease and anxiety. The continuous decline in oil prices implies that the future may bring more severe challenges: how to survive and develop in an environment of oversupply?

OPEC, as a major player in the market, must respond. Although its recent downward expectations have caused a stir, in the face of the reality of a global economic slowdown, reducing supply and protecting prices are also options they must consider. Moreover, after experiencing rounds of ups and downs, the market's dependence on oil remains profound. However, between this dependence and reflection, where will the future landscape go?

Conclusion: A Deep Reflection on the Relationship Between Supply and Demand

At present, we can see that the unfavorable situation of oversupply has become the market mainstream. This is not only reflected in the numbers but also the result of the interplay of various forces. OPEC's attitude shift and the downward adjustment of demand forecasts seem to be quietly telling us that the winter of the global energy market has arrived.

We cannot judge the development of all this with numbers alone. Every swing, every change, is the market growing and transforming. Perhaps, only by deeply understanding the logic behind all this can we find direction in future oil price fluctuations.

Leave a Comment