Five weeks after the last interest rate cut, the European Central Bank (ECB) will announce its latest interest rate decision at 20:15 Beijing time on Thursday, with expectations for a second consecutive rate cut to accelerate the pace of easing. Previous data showed that while inflation in the eurozone was falling rapidly, the economy was also deteriorating. Analysts unanimously predict that the benchmark deposit rate will be lowered by another 25 basis points to 3.25% on Thursday. Tonight is expected to be the first time in 13 years that the eurozone's central bank has cut rates consecutively, marking a shift in its focus from curbing inflation to protecting economic growth. Eurozone economic growth has lagged far behind the United States for two consecutive years.

The money market has almost fully digested three rate cuts before March next year. According to surveys, economists expect the ECB to lower the deposit rate by 25 basis points at each meeting this week and before March next year. Respondents expect two more rate cuts in June and December next year, with the benchmark rate falling to 2%.

With the current eurozone inflation rate falling below 2% for the first time since 2021, the eurozone's economic outlook has become even more bleak, accelerating the quarterly pace of reducing borrowing costs. At the same time, the ECB's policy outlook faces many risk factors - from the Federal Reserve's easing policy to conflicts in the Middle East.

Paul Hollingsworth, Chief Economist for Europe at BNP Paribas, said: "The ECB's focus has shifted from excessive inflation to weak growth. From a risk management perspective, accelerating the pace of easing is completely reasonable, although high uncertainty still requires us to remain cautious."

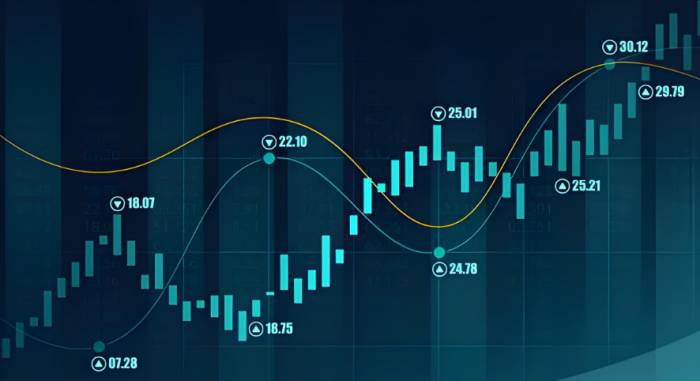

Interest Rates

ECB policymakers hinted in September that the third rate cut of this cycle might not come until the last meeting in December 2024, when the latest economic expansion and inflation forecasts - including the first forecast for 2027 - will be available.

However, recent data, such as the monthly purchasing manager's survey by S&P Global, showed a decline in private sector output, and Germany is preparing for a second consecutive year of output decline. Subsequently, investors and economists began to bet on a rate cut this month and other rapid follow-up measures.

Michala Marcussen, Chief Economist at Societe Generale Group, said: "The PMI data definitely favors a rate cut in October."

Many officials directly or indirectly agree with this expectation. Lagarde said that this month will take into account greater confidence in the timely return of inflation to the target. Francois Villeroy de Galhau, Governor of the Banque de France, said that a rate cut in October is "very likely." However, some hawks seem less optimistic about aggressive easing policies before 2025. In an interview, Martins Kazaks, Governor of the Bank of Latvia, warned the market not to "rush."

Economic Growth and InflationIn September, the European Central Bank (ECB) slightly downgraded its economic forecasts for the next three years, predicting a 0.8% economic growth in 2024. However, even this seems overly optimistic now.

Particularly concerning is the possibility that the slowing economic recovery may, at some point, impact the hitherto robust job market, further dampening economic activity. For the Bank of Portugal's Governor Mario Centeno, the danger lies in the return to the low inflation, low growth environment that existed before the pandemic outbreak.

Although the minutes of the September meeting mentioned the risks of falling below the target, some hawks remain more worried about the potential for excessive price pressures—especially the thorny issue of service sector inflation—and they argue that it is too early to declare victory.

However, inflation returning to the 2% target faster than expected could pave the way for more forceful rate cuts. Bank of Greece Governor Yannis Stournaras stated last week that this target could be achieved by mid-next year or earlier, while the ECB expects to achieve this target only by the end of 2025.

Labor Market

After years of surprising resilience, the eurozone labor market is finally showing cracks, which could help push the ECB to lower interest rates more quickly. Despite the unemployment rate remaining at a record low after inflation shocks and economic difficulties, policymakers see signs of a shift in the job market that could help convince them to support another reduction in borrowing costs this week.

As previously mentioned by Smart Finance, until July of this year, ECB President Christine Lagarde was still praising the strength of the European job market, stating that the ECB could "take time to gather new information" when formulating monetary policy. But now it seems that time has passed. Job growth slowed to 0.2% in the second quarter, and during the same period, the proportion of vacancies dropped from a peak of 3% to 2.6%. Surveys such as the monthly survey of purchasing managers by S&P Global also paint an increasingly bleak picture.

As a renowned labor economist, Bank of Portugal Governor Centeno sees early signs of a softening eurozone economy: "Some countries are sending more urgent warning signals than others, but all point to a possible reversal in the labor market."

Even hawkish officials acknowledge the issue. ECB Executive Board member Isabel Schnabel also believes that reduced demand for personnel makes it more likely for inflation to sustainably fall to the 2% target. Latvian Central Bank Governor Martins Kazaks points out the risk of a tipping point, where some companies may begin to lay off previously hoarded employees due to disappointing economic performance; he warns: "This could create some sort of snowball effect."

Manufacturing is a key issue—squeezed by weak external demand and domestic competitive disadvantages. At the same time, indecisive consumers mean that the service sector has not yet turned positive. Therefore, economists at Goldman Sachs predict that in the next few quarters, the eurozone's unemployment rate will rise to 6.7%. They say that if the economy underperforms, worse outcomes could occur—which supports their rationale for cutting interest rates at every meeting starting this week, until the deposit rate falls from the current 3.5% to 2%.Therefore, Goldman Sachs economists predict that in the next few quarters, the unemployment rate in the eurozone will rise to 6.7%. They say that if the economy performs poorly, worse outcomes may occur—supporting their rationale for cutting interest rates at every meeting starting this week until the deposit rate drops from the current 3.5% to 2%.

The rationale for accelerating easing policies is that a softening job market usually translates into thinner pay raises, thereby reducing inflation. Barclays economists recently wrote: "If the labor market continues to cool, workers may accept more moderate pay raises in upcoming wage renegotiations in exchange for job security."

The European Central Bank assumes that the 2% inflation target will be consistently achieved in the second half of 2025, based on a slowdown in wage growth; however, it also does not want the labor market and compensation growth to slow down too much.

Bank J. Safra Sarasin economist Karsten Junius said: "The eurozone's labor market still appears to be quite resilient, but there are also clear signs of weakness. The European Central Bank should also respond to this, ensuring that a significant increase in unemployment does not lead to a real recession. This also implies the initial effects of interest rate cuts."

Geopolitical risks

Further complicating the issue is the difficulty of measuring the ripple effects of global political developments.

Meanwhile, a significant escalation in the conflict between Israel and Iran could plunge the entire region into conflict, triggering a surge in oil prices. Policymakers must also weigh how China's stimulus plan may alter the economic outcomes in Europe.

Deutsche Bank analysts said in a recent report: "In 2025, eurozone economic growth, inflation, and monetary policy may take multiple paths."

Market communication

Therefore, Lagarde may be tight-lipped about the speed and extent of further actions—emphasizing the European Central Bank's "data-dependent" and "meeting-by-meeting decision" approach, without correcting market expectations for another interest rate cut in December.The currency market has almost entirely priced in three interest rate cuts before March of next year. Most European Central Bank (ECB) observers believe that the likelihood of rate cuts at each meeting before spring is a foregone conclusion.

According to a survey of economists, the ECB will accelerate the pace of interest rate cuts in the coming months to stimulate the economy—reducing borrowing costs to non-restrictive levels by the end of 2025. With the current inflation rate slightly below the 2% target, economists expect the ECB to lower the deposit rate by 25 basis points at each meeting this week and before March next year. Respondents anticipate two more rate cuts in June and December next year, bringing the benchmark rate down to 2%.

Almost half of the respondents believe that by then, the interest rate will be at a neutral level, while about two-fifths expect the rate to be low enough to encourage economic expansion. Previous surveys predicted that the ECB's rate-cutting cycle would end in September 2025 at 2.5%.

Santander CIB analyst Antonio Villarroya said, "We expect the ECB to cut the deposit rate by 25 basis points at the meeting on October 17th and continue to cut rates by 25 basis points at each meeting before March. At that time, the interest rate level may still be above the neutral level, so we expect the ECB to announce a 25 basis point rate cut in the second quarter of next year, most likely in June."

Most economists also believe that officials reiterated that as long as necessary, the Governing Council will maintain a policy that is "sufficiently restrictive" to ensure that inflation reaches and remains at 2% in the medium term. However, some officials are already considering adjusting the interest rate to a neutral level that neither stimulates nor restricts growth if the inflation target is achieved.

Although the neutral interest rate can only be estimated, it is considered to be between 1.5% and 3%. Pacific Investment Management Company (PIMCO) portfolio manager Konstantin Veit said that discussions surrounding the "appropriate neutral policy interest rate configuration" are expected to intensify next year.

Leave a Comment